mississippi sales tax calculator

This includes the rates on the state county city and special levels. Ad Your Business Can Automate Sales Tax and File Returns for Free in 24 States with Avalara.

How To Charge Your Customers The Correct Sales Tax Rates

Mississippi Sales Tax Comparison Calculator for 202223.

. The average cumulative sales tax rate in Toomsuba Mississippi is 7. Ad Register and Subscribe Now to work on MS RE-Tax Sales- Complaint more fillable forms. Just enter the five-digit zip.

Ad Your Business Can Automate Sales Tax and File Returns for Free in 24 States with Avalara. Our tax preparers will ensure that your tax returns are complete accurate and on time. Average Local State Sales Tax.

Sales Tax Laws Title 27 Chapter 65 Mississippi Code Annotated 27-65-1 Use Tax Laws Title 27 Chapter 67 Mississippi Code Annotated 27-67-1. Mississippi was listed in Kiplingers 2011 10 tax-friendly. You can always use Sales Tax calculator at the front page where you can modify percentages if you so wish.

This includes the rates on the state county city and special levels. The Mississippi MS state sales tax rate is currently 7. Below is a table of common values that can be used as a quick lookup tool for an average sales tax rate of 7 in Olive Branch Mississippi.

For example Jackson Mississippi has a 1 local. Maximum Possible Sales Tax. The average cumulative sales tax rate in West Mississippi is 7.

Pascagoula is located within Jackson County. Maximum Local Sales Tax. Collect sales tax at the tax rate where your business is located.

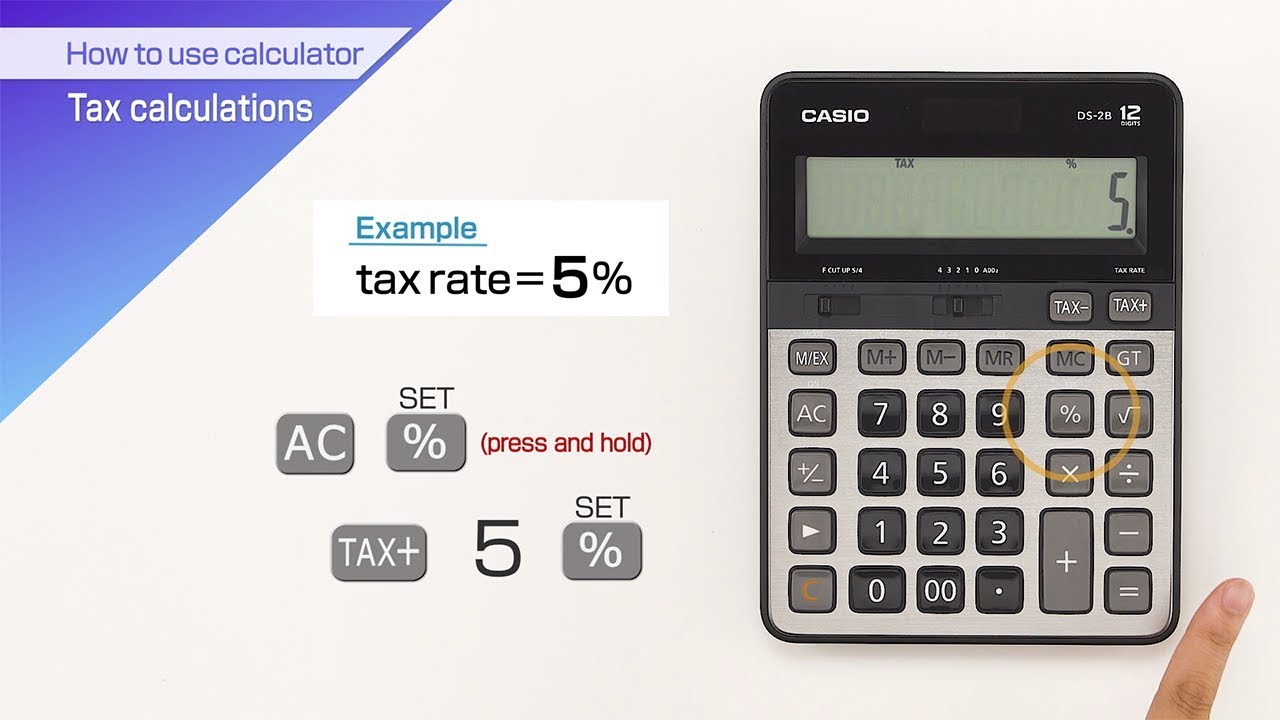

You can calculate the sales tax in Mississippi by multiplying the final purchase price by 05. The base state sales tax rate in Mississippi is 7. West is located within Holmes County MississippiWithin.

Sales Tax Table For Olive Branch Mississippi. All sales of tangible personal property in the State of Mississippi are subject to the regular retail rate of sales tax 7 unless the law exempts the item or provides a reduced rate. Our income tax calculator calculates your federal state and local taxes based on several key inputs.

This includes the rates on the state county city and special levels. Your household income location filing status and number of personal. The average cumulative sales tax rate in Utica Mississippi is 7.

Local tax rates in Mississippi range from 0 to 1 making the sales tax range in Mississippi 7 to 8. Utica is located within Hinds County MississippiWithin. A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the.

The calculator will show you the total sales tax amount as well as the. Sales and Gross Receipts Taxes in Mississippi amounts to 53. Fayette is located within Jefferson County.

This includes the rates on the state county city and special levels. You can use our Mississippi Sales Tax Calculator to look up sales tax rates in Mississippi by address zip code. Ad Reduce complexity by outsourcing the preparation and filing of sales tax returns to Sovos.

Mississippi Code at Lexis Publishing. The Mississippi Sales Tax Comparison Calculator allows you to compare Sales Tax between different locations in. Our Certified Software Makes It Easier to Manage Multi-State Tax Compliance.

For example lets say that you. The average cumulative sales tax rate in Fayette Mississippi is 7. Toomsuba is located within Lauderdale County.

Our Certified Software Makes It Easier to Manage Multi-State Tax Compliance. 54 rows The Sales Tax Calculator can compute any one of the following given inputs for the remaining two. Depending on local municipalities the total tax rate can be as high as 8.

2022 Mississippi Sales Tax Table. Bloomberg Tax Expert Analysis Your Comprehensive Mississippi Tax Information Resource. Find your Mississippi combined state.

This includes the rates on the state county city and special levels. You can look up your local sales tax rate with TaxJars Sales Tax Calculator. Before-tax price sale tax rate and final or after-tax price.

Ad Be the First to Know when Mississippi Tax Developments Impact Your Business or Clients. How to Calculate Mississippi Sales Tax on a Car. The average cumulative sales tax rate in Pascagoula Mississippi is 7.

PdfFiller allows users to edit sign fill and share all type of documents online. Mississippi State Sales Tax.

Mississippi Tax Rates Rankings Ms State Taxes Tax Foundation

What S The Car Sales Tax In Each State Find The Best Car Price

Mississippi State Taxes 2021 Income And Sales Tax Rates Bankrate

Use This Sales Tax Calculator To Figure Sales Tax Or Vat Gst At A Rate Of 7 75 Free To Download And Print Tax Printables Sales Tax Tax

Mississippi Tax Rate H R Block

How To Charge Your Customers The Correct Sales Tax Rates

Arkansas Sales Tax Calculator Reverse Sales Dremployee

Mississippi Sales Tax Guide And Calculator 2022 Taxjar

Mississippi Sales Tax Small Business Guide Truic

State Corporate Income Tax Rates And Brackets Tax Foundation

How To Calculate Sales Tax Methods Examples Video Lesson Transcript Study Com

Free Business Sales Tax Calculator Calculate Your Tax Now With Clickfunnels

Sales Tax Calculator For Purchase Plus Tax Or Tax Included Price

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation